Shale Oil Production Will Increase Again

(Bloomberg) -- Oil prices above $80 a barrel are once again spurring a revival of shale drilling in America'due south biggest oil field, where production is expected to return to pre-pandemic highs within weeks.

(Bloomberg) -- Oil prices higher up $eighty a barrel are once again spurring a revival of shale drilling in America's biggest oil field, where production is expected to return to pre-pandemic highs within weeks.

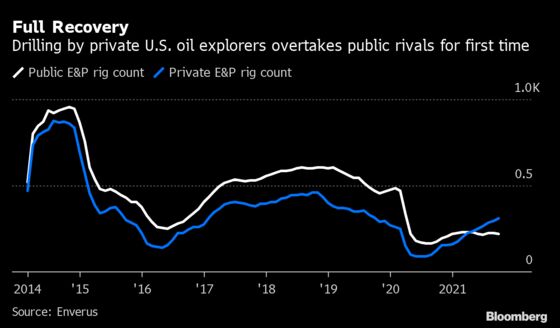

But this time, the surge is beingness driven by private operators, rather than the publicly traded companies that fueled the previous booms. And they see little reason to slow things down.

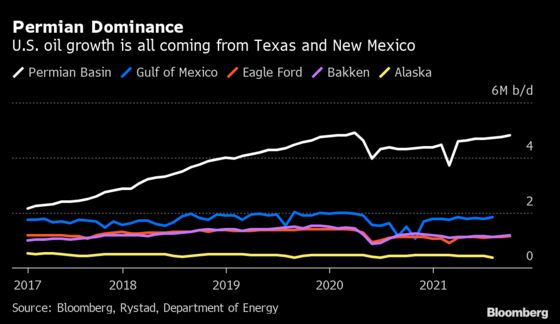

Increased admission to financing and potent oil demand has created an opening for closely held producers, most of whom are backed past private disinterestedness or family money, to ramp up output in Due west Texas and southeast New Mexico. With the other major U.S. shale basins either belongings steady or declining, according to BloombergNEF, the surging growth in the Permian isn't likely to gamble upsetting OPEC or tanking rough prices as it did in previous shale booms—at to the lowest degree not nevertheless.

"It's a win for the privates without being a loss for the oil markets," said Raoul LeBlanc, an analyst at IHS Markit Ltd. "The big takeaway is that private growth won't ruin the political party."

It'due south a tenuous residuum, and one that could shift quickly if oil prices continue to march higher. U.S. product growth was then strong over the by decade—and took so much market share from OPEC and its allies—that the cartel was willing to engage in all-out supply wars in both 2014 and 2020. The temperature has since come downwards as global demand for oil surges, especially amid a demand to supply fuel-hungry Europe and Asia, removing some competitive pressure between suppliers.

That dynamic is exactly the signal private drillers have been waiting for. Trigo Oil & Gas LLC, three-person upstart company, just drilled its commencement two wells in Reeves Canton, Texas, most the New Mexico border, with a 3rd on the way. After spending nearly of the pandemic trying unsuccessfully to finance the wells, Trigo scored deals in August with two Oklahoma City-based investors, right earlier a lease was nearly to expire, said its 37-year-old chief executive officeholder, Travis Wheat.

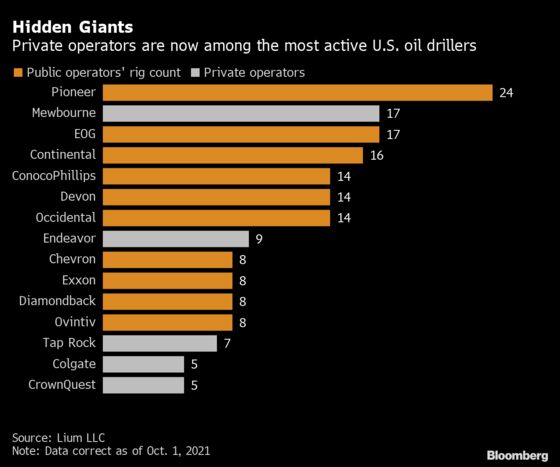

Private oil companies like Wheat's will make up more than half of U.S. production growth next year, Rystad Free energy said. And the surge has already started. Co-ordinate to onshore U.S. rig data from Lium LLC, picayune-known Mewbourne Oil Co., founded by Louisiana-born army officer Curtis Mewbourne in 1965, is now running 17 drill rigs in the U.S., more Exxon Mobil Corp. and Chevron Corp. combined. Effort Energy Resources LP, endemic by octogenarian billionaire Autry Stephens, and CrownQuest Operating LLC, led by Republican donor Tim Dunn, are together operating the same number of rigs as Permian heavyweight ConocoPhillips.

With individual fleets running hot, production from the Permian Bowl will probable reach its pre-pandemic record high of 4.ix million barrels a day as presently as this calendar month and will go on climbing steadily in 2022, Rystad Energy forecasts. The Permian is a peculiarly attractive place to ramp up product considering of its low breakeven costs and high rates of productivity.

Then what are all the public companies in the Permian doing? They have ratcheted back growth rates significantly.

Chastened by a decade of poor returns, public companies such as Pioneer Natural Resources Co. and Diamondback Energy Inc. are paying dorsum debt and passing profits dorsum to shareholders via dividends and stock buybacks rather than reinvesting the majority of their cash in new wells. Integrated majors Exxon and Chevron are besides preaching prudence. Public shale companies can "walk and chew gum" with prices around $80 a butt, IHS's LeBlanc said, meaning they can keep growing production just modestly and however render pregnant amounts of cash to investors.

The restrained strategy for the public companies is working for them: V of the 10 best-performing stocks in the S&P 500 this twelvemonth are shale.

That newfound austerity ways public oil companies in the U.Southward. at present await similar less of a risky investment, allowing them to concenter the lowest bond yields they've ever seen. Merely considering they're using their cheap credit to retire debt instead of fuel new exploration, it will take until 2023 before the land's total production will reach pre-Covid levels at electric current prices, three of the four major forecasters surveyed by Bloomberg said. But Enverus forecasts the U.S. to be at its pre-pandemic loftier by December next year.

To be certain, shale oil production is notoriously difficult to predict: If prices march quickly upward as has happened lately in natural gas, producers tin reply with more wells within months. Ascension costs to drill and complete in the shale patch due to supply-chain snarls and widespread aggrandizement could also shift the equation. And if more public drillers buy out their private rivals, equally was the case with Pioneer buying DoublePoint Free energy LLC for $6.4 billion before this year, the new public owners might put a cap on action. Egged on by investors eager to encounter more consolidation, there have been 159 deals in the U.South. oil and gas sector and so far this year, according to information compiled past Bloomberg, more than in all of 2020.

Only for now, private producers are finding open up road with little pushback from OPEC or the majors to slow them down.

That'southward music to Wheat's ears. The former high school quarterback, who cut his teeth in the Barnett Shale after graduating college and named his company after the Castilian word for wheat, landed Trigo's financing right at the nick of time. After cratering during the pandemic, Due west Texas Intermediate crude futures are upwardly about 60% this year, making those brand-new wells highly profitable. West Texas Intermediate crude rose equally much as 3.6% Monday to trade to a higher place $82 per barrel for the first fourth dimension since October 2014.

"Capital was and then hard to come across," Wheat said. "We kept driving, kept moving forrad, got fortunate and fabricated a petty chip of fate."

Incentivized by college oil prices, Saudi Arabia and the coalition of oil-producing countries are expected to become along with shale's higher output, for now.

"The large assumption for next year is that as the shale growth continues, OPEC does want to continue the prices above $65," Al Salazar, vice president of intelligence at Enverus, said in an interview. "We think OPEC+ will have to cut barrels in order to maintain prices in the high $60s erstwhile in the first half of next yr."

gerhardbantiong1987.blogspot.com

Source: https://www.bloombergquint.com/markets/shale-oil-production-back-near-pre-pandemic-levels-in-u-s-permian-region

Postar um comentário for "Shale Oil Production Will Increase Again"